swap in forex means

Islamic or swap-free accounts have recently been offered to the forex market as a new alternative to traditional accounts. When you trade on margin using leverage and hold a position overnight you.

Basically a swap is the interest rate differential between the.

. A currency pair such as. Dealers dont have to pay a fee or commission to use these. Ad Trade Forex with MT4 tools OANDA Low Spreads.

If you enable the forex swap-free option all other trading conditions of Standard or Eurica accounts remain the same. So what counts as the end of day in forex. Le swap est un concept impliquant quune fois que vous laissez une position ouverte sur les marchés financiers pour le jour suivant vous payez ce droit.

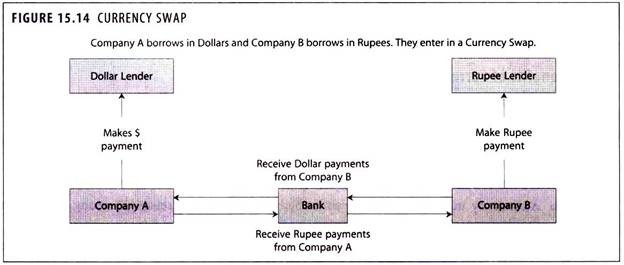

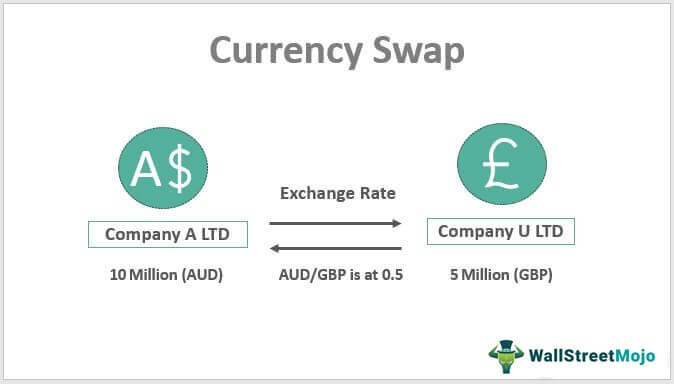

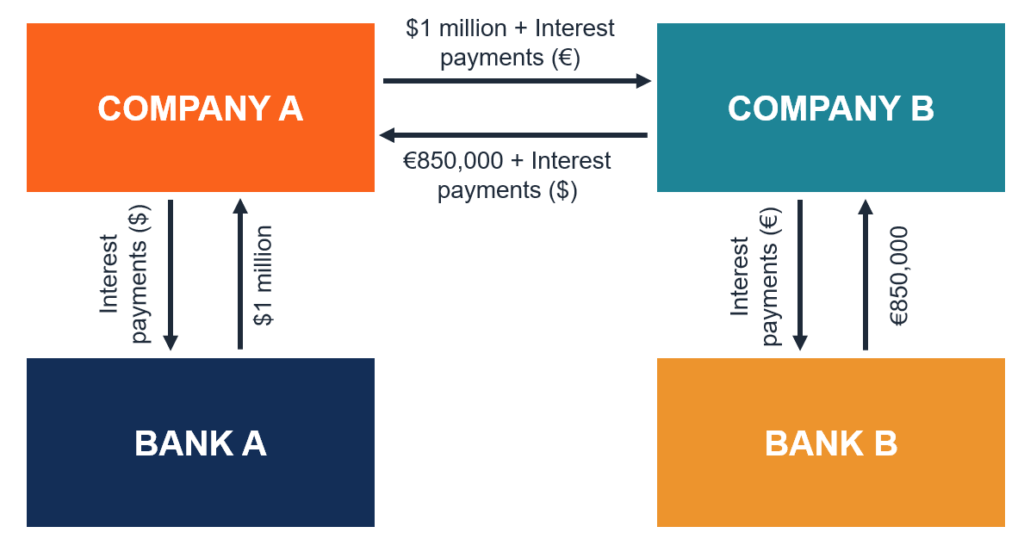

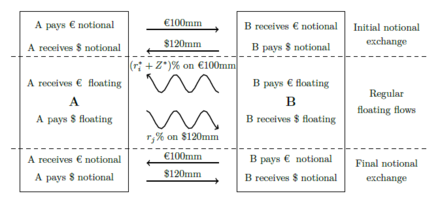

What is Swap in Forex. A foreign currency swap is an agreement to exchange currency between two foreign parties often employed to obtain loans at more favorable interest rates. Try a Free Demo.

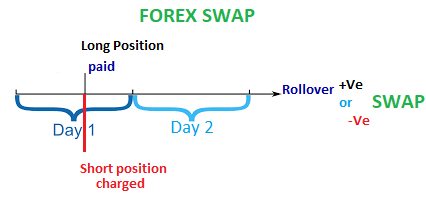

A forex swap is a commission or rollover interest charged by a broker for extending. There are two types of swaps. However the meaning of swap in trading be it money market stocks or forex is slightly different.

Instead a swap in Forex is an interest fee which needs to either be paid in or will be charged added to your account when the days trading. A swap in forex refers to the interest that you either earn or pay for a trade that you keep open overnight. A swap in forex occurs if you are holding an open position overnight.

In forex a swap is a commission or rollover interest that a broker charges when a trader decides to keep their position open overnight. The forex market is open 24 hours a day 5 days a week. Swap in forex is an agreement about the exchange of currencies at.

Well time zones may vary but basically the day is considered over at 500 PM New York time. Your account will be either credited or debited depending on the trade direction and traded pair. A swap which is also known as the rollover fee is the cost you need to pay if you keep a position open overnight.

The Forex swap or Forex rollover is a type of interest charged on positions held overnight on the Forex market. Ad Trade Forex with World-Class Technology Innovative Tools and Knowledgable Service. Swap in forex trading is simply the interest rate that is either paid or charged to you at the end of each trading day.

Forex swap is not actually a physical swap. What is Swap in Forex. When trading Forex or other CFD Contract for Difference financial instruments swap also known as rollover refers to the interest paid or received for keeping a position overnight.

A similar swap is also charged on Contracts For Difference CFDs. Si vous pratiquez le trading à court. Calculation of Forex Swap Each currency has its own interest rate and each forex transaction involves two currencies and therefore two different interest rates.

Ad Learn how to trade Forex with our ultimate and updated beginners guide. Swap long used for keeping long positions open overnight and Swap. Swap free trading accounts do not generate swap.

Get insights that every beginner should know to successfully trade the forex market. An FX swap or currency swap involves two simultaneous currency purchases one on the spot rate and the other through a forward contract.

Secrets Behind Forex Swap Complete Guide Freeforexcoach Com

The Ultimate Guide To Forex Swaps Forex Academy

Currency Swap Meaning And Benefits Foreign Exchange Financial Management

/dotdash_final_Currency_Swap_vs_Interest_Rate_Swap_Whats_the_Difference_Jan_2021-01-d0d9bf99a16c467daeab2fd073b67051.jpg)

Currency Swap Vs Interest Rate Swap

What Is Swap In Forex Trading How Does It Works

Swap Definition Forexpedia By Babypips Com

Currency Swap Definition Example How This Agreement Works

What Are Swaps In Forex Forex Academy

Currency Swap Contract Definition How It Works Types

Secrets Behind Forex Swap Complete Guide Freeforexcoach Com

Forex Trading Academy Best Educational Provider Axiory Global

Currency Swap Quantra By Quantinsti

Currency Swap Agreement Explained With Example Youtube

:max_bytes(150000):strip_icc()/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)